4 Examples of the Power of Time, Interest, and Investment

Continued contributions and compounding interest are powerful tools for the future of the children in your life.

When we launched Youth Savings Certificates (YSC) in August 2024, we not only hoped to generate curiosity in the certificates themselves but to also see the custodians who opened the certificates contribute to them regularly, facilitating long-term future growth for those minors in their lives. Whether these kids need the funds for college, trade school, a vehicle, a service trip, or some other use, our goal is to create a solid position from which they can start their adult lives.

Now, you may be thinking, “I really don’t have the extra funds needed to see significant long-term growth. Don’t you need lots of money to invest?”

We’re here to debunk that myth and show you just how much of a difference small, consistent contributions can make.

4 Examples

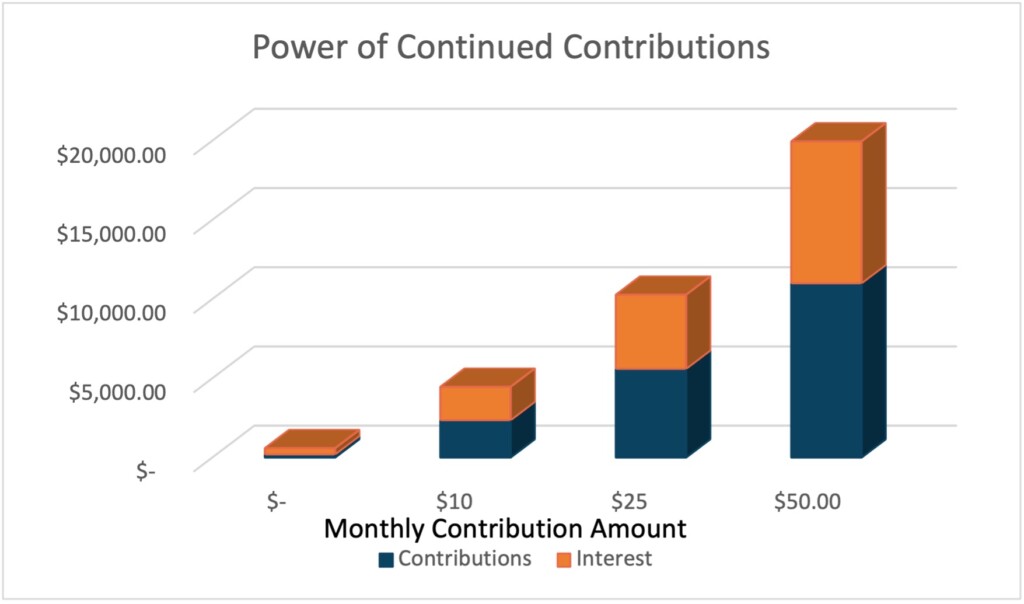

We want to lay out 4 examples to show just how powerful long term, continued contribution and monthly compounding can be. For these examples, we will make the following assumptions:

- The current 5.84% interest rate on YSCs remains unchanged for the entire investment period. (Despite this assumption, interest rates on the YSCs are variable.)

- The YSC is opened with an initial investment of $200.

- The initial investment is made when the child is born, and they access the funds on their 18th birthday (an 18-year investment period).

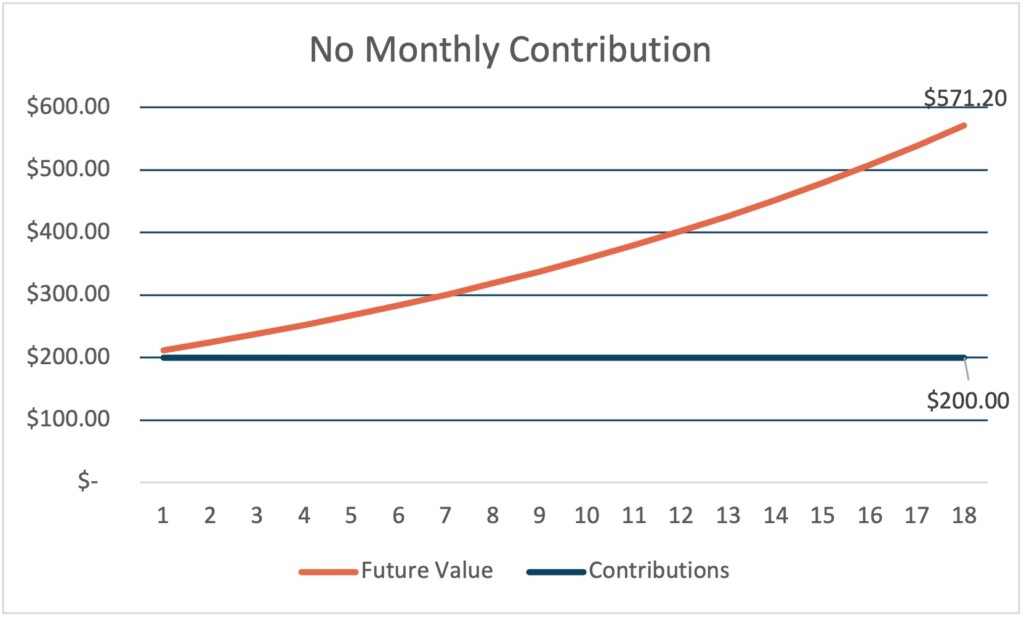

Example 1

If the initial $200 investment in the YSC is left to accrue interest without any additional investment, the resulting balance at the end of our assumed 18-year investment period is $571.20.

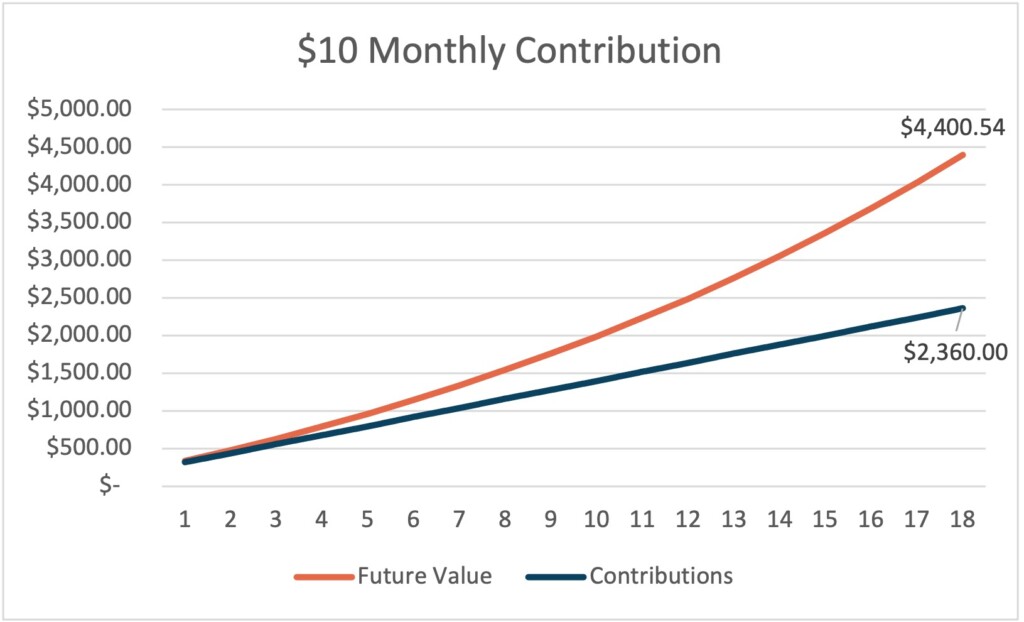

Example 2

By comparison, even a small recurring contribution of $10 per month starts to have a big impact down the road. In this example, the resulting balance is $4,400.54, with $2,360 of that being contributions and $2,040.54 being interest.

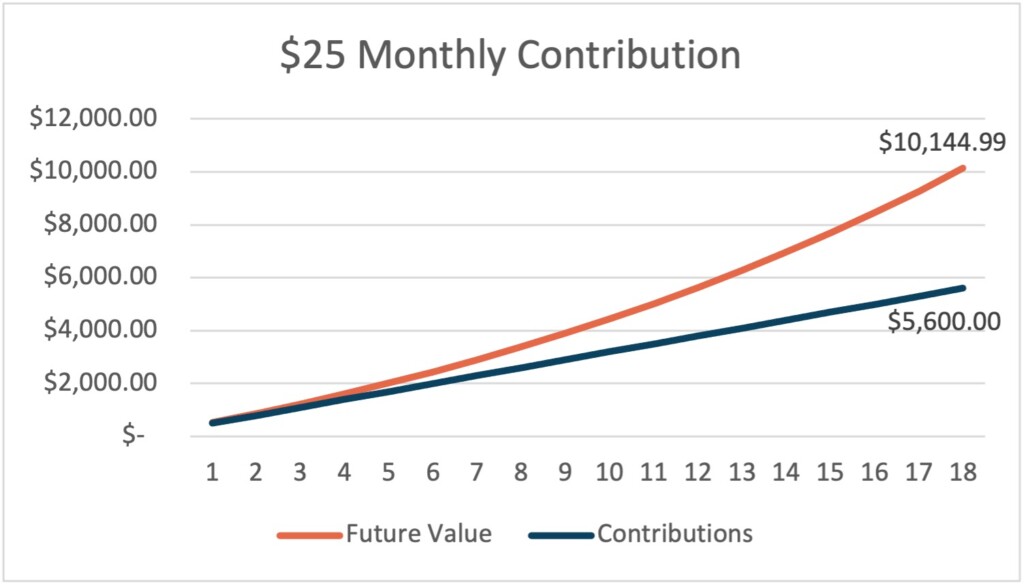

Example 3

If you were to increase contributions to $25 per month, the total YSC balance really starts to jump, totaling $10,144.99. In this example, $5,600 comes from those monthly contributions while $4,544.99 is compounded interest.

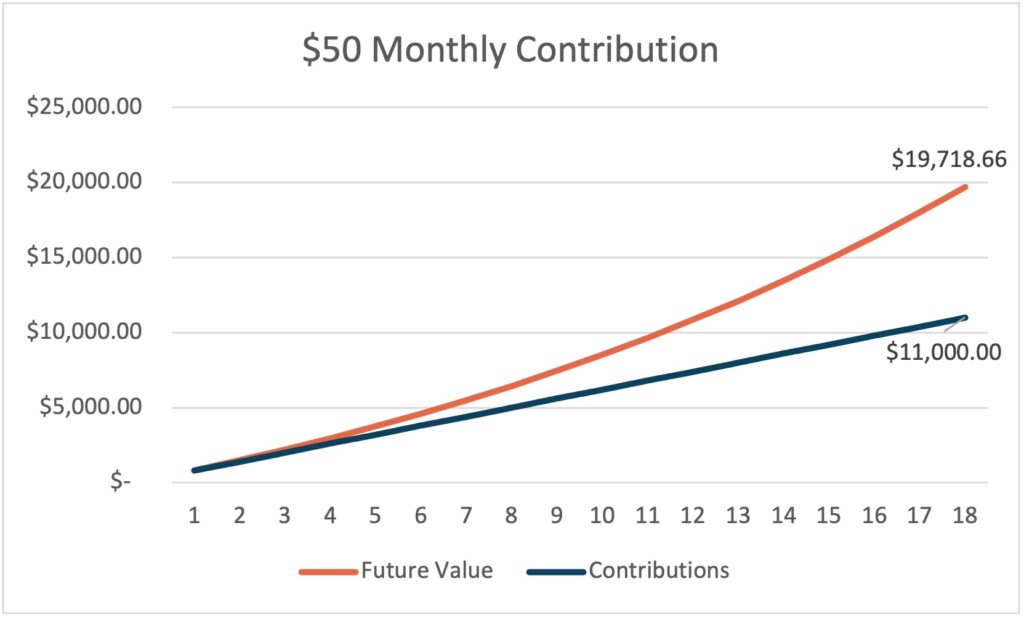

Example 4

For this final example, we increase recurring contributions to $50 per month. After our assumed 18-year investment period, the balance increases even further to $19,718.66, with $11,000 being contributions and $8,718.66 being interest.

Final Comparison

To clearly see the difference small, recurring investments can make, let’s quickly compare the four examples side-by-side:

Next Steps

Have you already started YSCs for the special kids in your life?

As we approach Thanksgiving and Christmas, consider starting a regular contribution to their YSC as part of your gift them this year. As you can see above, a small contribution each month can make a big difference in the future. You can log in on the “My Account” page to make adjustments or contact Sean Kleckner to set up regular contributions.

Interested in starting YSCs for the children in your life?

Learn more about Youth Savings Certificates and contact Sean Kleckner when you’re ready to get started.

Learn More

Contact Sean Kleckner for more information.

skleckner@bicfoundation.org

(717) 918-9942

With investments in the BIC Foundation like the Youth Savings Certificate, you can have the satisfaction of not only earning an interest rate but also funding a ministry that seeks to share the love of Jesus and make a difference in the world. Funds invested with the BIC Foundation empower BIC congregations and ministers around the world to grow ministries and make a lasting impact in their communities.

This is neither an offer to sell nor a solicitation of an offer to buy the investments described herein. An offer with respect to Brethren in Christ Foundation investments can be made only by the prospectus. No offer or sale of investments is made in any jurisdiction where the offer or sale is not in compliance with applicable law. Offers and sales may be made only by an authorized officer of the Foundation. These products are uninsured debt obligations of the Foundation. These products are not savings or deposit or other obligations of a bank and are not insured by the FDIC, SIPC, any state insurance fund or any other governmental agency.

The financial condition of the Foundation is the only protection for investors. There is no guarantee that the Foundation will not experience declines in net assets. Both the Loan Fund and the Trust Fund have experienced decreases in net assets in some prior years due to declines in market value of investments. Further, charitable activities of the Trust Fund subject it to increased volatility in changes in net assets over annual periods. Please refer to our prospectus, including the “FIVE-YEAR SUMMARY OF FINANCIAL STATEMENTS” and “USE OF PROCEEDS” included therein.

The value of the Foundation’s investments can decrease. The Foundation may invest certain of its available funds that are not used for loans in investments that are subject to fluctuation in market values. There is no guarantee that the Foundation will not experience declines in net assets. Please refer to our prospectus, including the “FIVE-YEAR SUMMARY OF FINANCIAL STATEMENTS” and “USE OF PROCEEDS” included therein.